Biocon Integrates Biocon Biologics as Wholly Owned Subsidiary

Indian biopharmaceutical company Biocon Limited has announced its decision to fully integrate its biosimilar unit, Biocon Biologics, making it a wholly owned subsidiary. The announcement was made on Saturday, with plans to acquire remaining stakes in Biocon Biologics from Serum Institute Life Sciences, Tata Capital Growth Fund II, and Activ Pine LLP. The transaction involves a share swap arrangement, wherein shareholders will receive 70.28 Biocon shares for every 100 shares of Biocon Biologics. This transaction values Biocon Biologics at approximately $5.5 billion (around 405.78 Indian rupees or $4.51 per share).

Shreehas Tambe, the current Chief Executive Officer of Biocon Biologics, is set to take over as the CEO and Managing Director of the newly integrated entity following the merger. Kedar Upadhye will assume the position of Chief Financial Officer. Siddharth Mittal, who is the current CEO of Biocon, will transition to a group leadership role, reflecting a strategic shift within the company’s leadership structure.

The integration process is anticipated to conclude by March 31, 2026. In a previous interview, Shreehas Tambe mentioned that Biocon has ambitions to list its significant biosimilars business by March 2026, targeting a double-digit market share in the core United States market for new product launches.

Biosimilars are biologic medical products highly similar to already approved reference products, offering a more affordable alternative to expensive biologic drugs. These medications are commonly used to treat various diseases, including cancer and autoimmune disorders.

As part of the integration, Biocon is also set to acquire the remaining stake held by Viatris, another major player in the biopharmaceutical sector, for $815 million. This acquisition will comprise $400 million in cash and the remainder through a share swap agreement. Biocon is planning to raise additional capital of up to 45 billion Indian rupees (approximately $500 million) via a Qualified Institutional Placement (QIP). The funds raised will primarily cover the cash component payable to Viatris.

Kiran Mazumdar-Shaw, Executive Chairperson of Biocon, commented on the merger, stating, "The combined entity will offer a unique portfolio spanning biosimilars, insulins, GLP-1 peptides, and complex generics, positioning Biocon among the few global players with scale in both generics and biologics." She highlighted the company's focus on therapeutic areas crucial to global health, such as diabetes, oncology, and immunology, which collectively account for nearly 40% of pharmaceutical revenues worldwide.

This strategic move reflects Biocon's ongoing efforts to fortify its market position and explore new avenues for growth. The integration of Biocon Biologics is expected to unlock significant value for the combined entity, enhancing its competitive edge in the rapidly evolving biopharmaceutical landscape. The board has also established a strategy committee to assess potential mergers or public listings for its biologics arm, indicating a forward-looking approach to corporate strategy in this dynamic industry.

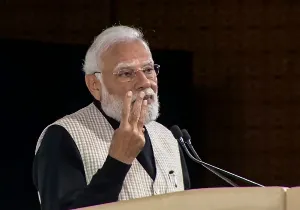

PM Modi Emphasises National Goals in India's Reform Agenda

India's Right to Disconnect Bill Aims to Enhance Employee Wellbeing

IndiGo Flight Disruptions Spark Outrage Among Passengers

Tension in Murshidabad as Suspended MLA Lays Mosque Foundation Stone