India and US Trade Deal: Tariff Reductions Announced

A recent announcement regarding a trade deal between India and the United States has generated considerable optimism among various Indian industries. However, questions remain about the specifics of the deal despite comments from India’s Commerce Minister Piyush Goyal. The trade deal involves a significant reduction in tariffs on Indian imports by the US, dropping from the current rate of 50% to 18%. While this reduction has been widely welcomed, the precise timeline for when these changes will take effect is still unclear.

U.S. President Donald Trump indicated that these tariff cuts would happen 'immediately'; however, Goyal mentioned that further details would be provided 'soon'. This discrepancy has led to uncertainty regarding whether the agreement is part of a more extensive Bilateral Trade Agreement or merely a limited arrangement focused on tariff changes.

Additionally, President Trump claimed that Indian Prime Minister Narendra Modi has 'agreed to stop buying Russian oil'. This statement raises significant issues for the Indian government. A complete cessation of Russian oil imports would necessitate India to seek new suppliers, impacting approximately one-third of its oil imports. The ramifications for India’s longstanding relationship with Russia, a key ally and major supplier of defence equipment, must be carefully addressed.

Moreover, the potential shift towards increasing imports from Venezuela poses refining challenges and complicates the overall landscape of the deal. There remains ambiguity regarding specific commitments made by India to the US, including possible tariff concessions and investment promises. Goyal has assured that sensitive agricultural products and dairy will be excluded from any tariff reductions, but further clarification is necessary given the statements made by Trump's administration.

Despite these uncertainties, the announcement has instilled confidence in the Indian stock markets and strengthened the rupee. Industries such as textiles, apparel, footwear, leather, and engineering goods, which have suffered under the previous tariff regime, are expected to benefit from this deal. Furthermore, these sectors may also find gains through an anticipated India-European Union trade agreement set to commence this year.

Despite the potential for enhanced competitiveness, Indian sectors may still face slightly higher tariffs than some competitors in Southeast Asia, due to the Most-Favoured Nation status they enjoy. The growing optimism following this trade development is evident in the latest projections for the upcoming budget, which aim to support industries by bridging existing tariff gaps.

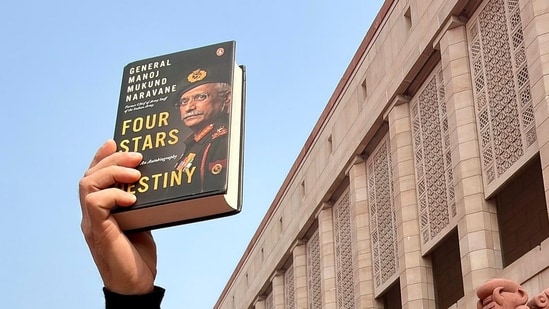

General Naravane's Memoir Ignites Political Debate in India

India-US Trade Agreement Sparks Growth in Key Sectors

WhatsApp Faces Supreme Court Warning Over Privacy Practices in India

Severe Snowfall in Japan Claims 30 Lives Amidst Ongoing Crisis