IMF funding for Pakistan rises as board approves additional $1.2bn

The IMF announced the decision after its Executive Board completed two reviews of Pakistan’s economic programmes. The approvals cover roughly $1bn under its main lending arrangement and about $200m from a climate-linked facility designed to help countries strengthen their resilience to environmental shocks. According to the Fund, these latest disbursements raise Pakistan’s total receipts since last year to approximately $3.3bn.

The multiyear financing framework was launched to help Pakistan rebuild foreign exchange reserves, improve the performance of state-owned enterprises, and strengthen tax administration. Loan instalments are scheduled over a 37-month period, provided Islamabad meets conditions set out in the programme.

Pakistan has long depended on external assistance from the IMF and other partners to manage recurring fiscal and balance-of-payments pressures. The country narrowly avoided default in 2023 before securing a $7bn rescue package the following year. It has since become one of the IMF’s largest borrowers, behind Argentina and Ukraine. Alongside IMF support, Pakistan also entered a decade-long $20bn arrangement with the World Bank earlier this year.

Prime Minister Shehbaz Sharif welcomed the IMF’s latest approval, describing it as an endorsement of his government’s reform agenda. He said the decision reflects “effective implementation” of commitments made to the Fund and argued that Pakistan’s efforts to stabilise the economy are being recognised internationally. In a statement, Mr Sharif credited senior officials, including Finance Minister Muhammad Aurangzeb and the country’s military leadership, for helping drive difficult policy changes. He said Pakistan’s reform and digitalisation measures had become a “case study”, while cautioning that moving from stabilisation to sustained economic growth would require continued discipline.

The IMF, in its assessment, said Pakistan had achieved “significant progress” in restoring economic stability, despite the impact of this year’s monsoon floods and what it described as a tough global backdrop. The Fund highlighted an improved fiscal position, an expansion in foreign exchange reserves to $14.5bn, and early signs of growth strengthening. It noted that inflation had increased in recent months due to flood-related disruptions that pushed up food prices, but said price pressures were expected to ease.

Nigel Clarke, the IMF’s deputy managing director, said the authorities had delivered policy actions consistent with programme goals even after extreme weather in the recent monsoon season caused widespread damage and loss of life. He said Pakistan’s decision to maintain its budgetary targets while also providing emergency support to those affected by the flooding demonstrated a commitment to responsible fiscal management. “The implementation of reforms in Pakistan has helped to preserve macroeconomic stability despite recent shocks,” Mr Clarke said.

In its review, the Fund drew attention to Pakistan’s fiscal results, reporting a primary surplus of around 1.3% of GDP for the 2024–25 financial year, in line with expectations. It added that gross reserves had risen from $9.4bn a year earlier and were projected to increase further through 2026. Inflation, it said, remained largely driven by temporary food price spikes linked to weather-related supply disruptions.

Looking ahead, the IMF urged Pakistan to maintain tight monetary policy, allow the exchange rate to adjust freely to market forces, and proceed with overdue reforms in the energy sector. Mr Clarke said that safeguarding the financial viability of the power and gas industries was essential for boosting competitiveness. He noted that while tariff adjustments had helped reduce the accumulation of circular debt — losses that build up across the electricity supply chain — broader measures to cut generation costs, modernise distribution networks, and reduce inefficiencies were still required.

The climate-linked portion of the financing will support a series of initiatives aimed at strengthening Pakistan’s disaster preparedness. These include improving water management, incorporating climate risk into public investment planning, and enhancing the quality of climate-related financial reporting. The IMF Board said the scale of the recent floods underscored the urgency of accelerating reforms that reduce vulnerability to extreme weather.

The Fund also acknowledged steps to improve transparency and governance. It noted the publication of a Governance and Corruption Diagnostic Assessment and described it as a “welcome step” in advancing efforts to strengthen public-sector oversight.

Context

Pakistan’s economy has been under acute strain for several years, hit by high inflation, energy shortages and repeated climate-related disasters. The country’s dependence on imported fuel, combined with a narrow tax base and low export earnings, has repeatedly forced it to seek assistance from multilateral lenders and allied governments. Analysts say that without sustained structural reforms, including modernising the energy sector and broadening tax revenues, Pakistan will continue to struggle with fiscal pressures that limit investment in social services and infrastructure.

The IMF’s latest disbursement offers short-term relief but comes with long-term expectations for policy discipline. How Pakistan balances recovery from flood damage with the need for continued austerity will shape its economic trajectory in the years ahead.

Trump Announces $12 Billion Aid Package for Struggling Farmers

South Korea Scrambles Fighter Jets Amid Russian and Chinese Activity

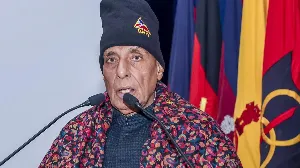

Rajnath Singh Launches 125 Border Infrastructure Projects Across India

New York Mayor-Elect Zohran Mamdani Advocates for Immigrant Rights