Kotak Mahindra Bank Announces Share Split in 1:5 Ratio

Kotak Mahindra Bank has officially announced that its board of directors has approved a stock split, a decision made public on November 21, 2025. This split will convert one existing equity share with a face value of ₹5 into five equity shares, each valued at ₹1. This corporate action aims to enhance liquidity and attract more retail investors by making shares more affordable.

The stock split is significant as it marks the bank’s first such action in 15 years. The last time Kotak Mahindra Bank executed a stock split was in 2010, when it divided its shares in a 1:2 ratio. The board stated that this move aligns with the bank's goals of increasing market participation and shareholder engagement.

"As we celebrate our 40th anniversary, we reaffirm our commitment to creating long-term value for our shareholders. This initiative is a step towards making our equity shares more liquid and accessible to a broader range of investors," said C. S. Rajan, Part-time Chairman of Kotak Mahindra Bank.

The bank has yet to announce the record date, which will determine the shareholders eligible to benefit from the stock split. This is a crucial detail for investors, as it indicates when current shareholders must own shares to receive the additional shares post-split.

On the day of the announcement, shares of Kotak Mahindra Bank closed at ₹2,086.50 on the National Stock Exchange, reflecting a modest decrease of 0.58%. Despite this dip, the stock has shown a positive trajectory overall, rising 17% this year and 20% over the past twelve months.

In its recent financial results, Kotak Mahindra Bank reported a 3% decrease in standalone profit for the second quarter of fiscal year 2026, amounting to ₹3,253 crore, down from ₹3,344 crore in the same quarter last year. However, total income increased to ₹16,239 crore, compared to ₹15,900 crore in the previous year, indicating resilience in its earnings despite the profit decline.

The bank's interest income also saw an uptick, reaching ₹13,649 crore, while its net interest income improved to ₹7,311 crore, marking a 4% growth year-on-year. This financial performance underscores the bank's stability and its continued attractiveness to investors, even amidst market fluctuations.

The board's decision to implement a stock split is expected to further bolster investor confidence and engagement as the bank continues its growth trajectory in the competitive Indian banking sector. The anticipated completion of this corporate action is expected within two months, pending necessary regulatory approvals.

India's New Labour Codes Enhance Worker Protections and Benefits

New York Mayor Zohran Mamdani to Meet President Trump at White House

Tejas Fighter Jet Crash in Dubai Claims Life of Pilot Namansh Syal

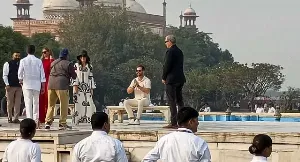

Donald Trump Jr. Visits Taj Mahal Before Attending Udaipur Wedding