Indian Stock Market Opens Lower Amid Global Economic Concerns

The Indian stock market experienced a downturn on Friday, with both the Nifty50 and BSE Sensex benchmark indices starting the day in negative territory. This decline follows a backdrop of weak international market signals. At 9:16 AM IST, the Nifty50 was noted at 26,109.45, reflecting a decrease of 83 points or 0.32%. Similarly, the BSE Sensex stood at 85,382.02, down by 251 points or 0.29%. Analysts predict that the market could continue to fluctuate, influenced by various domestic factors, global economic data, trends in foreign institutional investment, and the evolving state of trade relations between India and the United States.

Dr. VK Vijayakumar, Chief Investment Strategist at Geojit Investments Limited, commented on the heightened market volatility. He remarked, 'The Nasdaq, often seen as an indicator of the artificial intelligence sector, fell by 2.15% yesterday, marking a 4.4% decline from its intraday high.

Such market shifts suggest that more volatility may be on the horizon. Although various experts caution about a potential bubble in AI stocks, the CEO of Nvidia has expressed a contrasting view, stating, 'We see a different picture characterised by a sustainable rise of advanced AI systems.' This perspective suggests that, should the valuations adjust, renewed interest in AI stocks could emerge. Investors are advised to observe the market closely in this turbulent phase.

Dr. Vijayakumar further stressed that excessive speculative trading is prevalent among certain newly listed stocks in India and recommended that retail investors steer clear of such high-risk trades, which often lead to losses. He suggested a more prudent investment approach, focusing on acquiring high-quality stocks at reasonable valuations during market dips and adopting a patient holding strategy. He added, 'Given India's relative underperformance in this year's AI sector, it stands to gain if investment shifts away from AI stocks towards other sectors.

However, a significant crash would likely affect all markets, necessitating a cautious approach.' In Asia, equity markets fell following the fluctuations seen in US markets, where initial gains led by Nvidia dissipated as investors retreated from high-risk assets, including cryptocurrencies. Wall Street indices also saw a reversal of fortunes on Thursday, as the early optimism surrounding Nvidia's performance and US employment data faded, leaving investors uncertain about the future of the labour market.

Meanwhile, the US dollar was on track for its strongest weekly performance in over a month, as investors interpreted the latest employment figures as unclear indicators for future monetary policy from the Federal Reserve. On the domestic front, foreign portfolio investors acquired shares worth Rs 284 crore net on Thursday, while domestic institutional investors purchased shares worth Rs 824 crore net. It is important to note that the recommendations and views expressed by market experts are their own and do not necessarily reflect the views of The Times of India.

India's New Labour Codes Enhance Worker Protections and Benefits

New York Mayor Zohran Mamdani to Meet President Trump at White House

Tejas Fighter Jet Crash in Dubai Claims Life of Pilot Namansh Syal

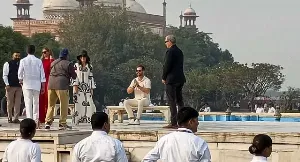

Donald Trump Jr. Visits Taj Mahal Before Attending Udaipur Wedding