Indian Rupee Depreciates to 90.70 Against US Dollar Amid Challenges

The Indian rupee experienced a decline of 36 paise, closing at 90.70 against the US dollar on 6 February 2026. This depreciation was influenced by rising crude oil prices and ongoing geopolitical uncertainty related to discussions between the United States and Iran.

The currency had shown strength during the earlier part of the trading session, boosted by the Reserve Bank of India's decision to maintain the repo rate at 5.25%. However, sustained foreign institutional investor outflows exerted pressure on the local currency, according to forex traders.

Initially, the rupee opened at 90.28 and fluctuated between a high of 90.18 and a low of 90.83 throughout the trading day before finally settling at 90.70. On the previous day, the rupee had strengthened by 13 paise, closing at 90.34.

Anuj Choudhary, a Research Analyst at Mirae Asset ShareKhan, remarked, "The rupee rose in the first half of the day as the Reserve Bank of India left the repo rate unchanged at 5.25%, in line with expectations. However, the rupee lost initial gains amid geopolitical uncertainty over U.S.-Iran talks." He further noted that there was potential for optimism regarding the India-U.S. trade deal, which could provide support for the rupee at lower levels.

Looking ahead, Choudhary projected the USD-INR spot price to trade within a range of ₹90.40 to ₹91.20.

In addition to currency fluctuations, the dollar index, which measures the strength of the U.S. dollar against a basket of six currencies, was slightly lower at 97.81. Brent crude oil prices rose by 1.38%, trading at $68.48 per barrel in futures markets.

On the equity front, the Sensex, which is a benchmark index of the Bombay Stock Exchange, gained 266.47 points to close at 83,580.40, while the National Stock Exchange's Nifty index climbed by 50.90 points, closing at 25,693.70. However, on the previous day, foreign institutional investors turned net sellers, offloading equities amounting to ₹2,150.51 crore as reported by exchange data. This trend highlighted the ongoing volatility and investor sentiment in the market as geopolitical and economic factors continue to shape trading conditions.

Lieutenant Governor Participates in Live Streaming of Pariksha Pe Charcha

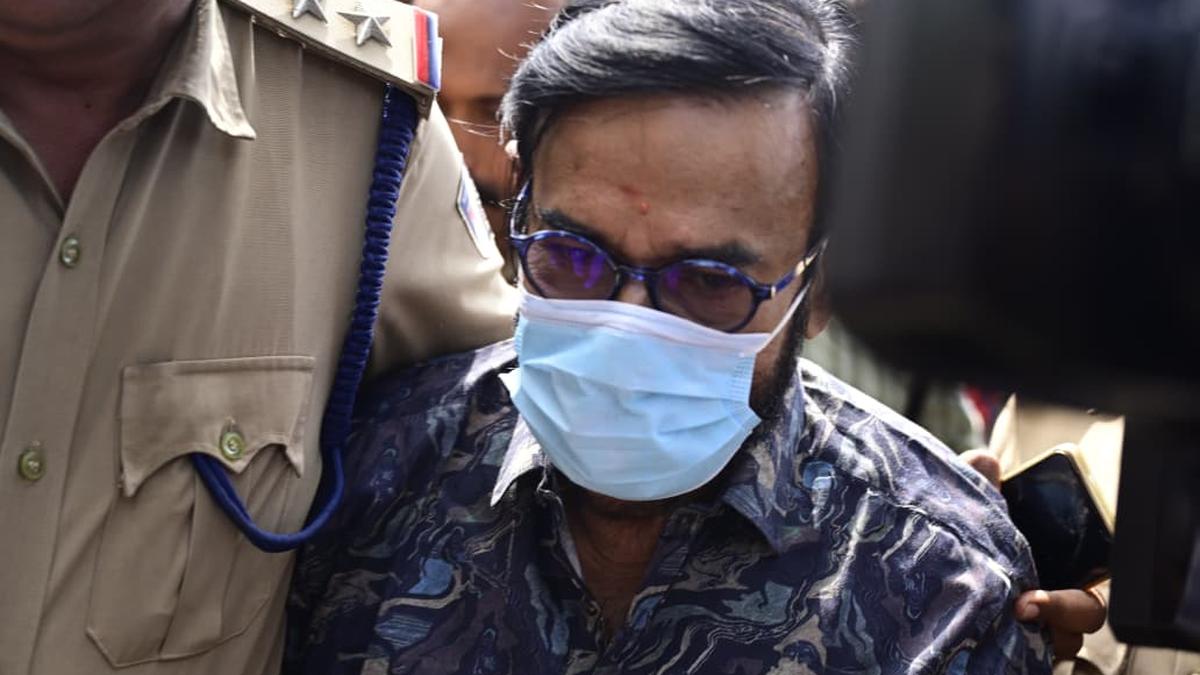

Kerala Actor Maniyanpilla Raju Detained in Hit-and-Run Incident

Iran-U.S. Nuclear Talks in Oman: Key Points and Developments

D K Shivakumar Responds to Yathindra on Chief Minister Future