Indian Government Pursues $30 Billion from Reliance and BP over KG-D6

The Indian government has initiated a claim seeking more than $30 billion from Reliance Industries Limited and British Petroleum (BP) regarding compensation for alleged deficiencies in gas production at the Krishna Godavari-D6 (KG-D6) fields. This assertion arises from accusations that the companies constructed facilities larger than necessary and subsequently failed to meet their natural gas output targets.

This claim was presented during proceedings before a three-member arbitration tribunal, which completed hearings on this long-standing dispute on 7 November 2023. The tribunal's decision is anticipated sometime in 2024, and the losing party is expected to seek a review of the outcome in the Supreme Court of India, as reported by various sources familiar with the case.

In these proceedings, the government is seeking monetary compensation for the natural gas that was not produced, as well as reimbursement of costs related to excess investments in infrastructure, fuel marketing, and interest payments. The total value of these claims has been estimated to exceed $30 billion.

In response, Reliance Industries has stated, "There is no claim of $30 billion against Reliance and BP," asserting that it is "factually incorrect" to suggest that such a demand has been made for underproduction from the KG-D6 gas field. The company clarified that a claim presented before an arbitration panel does not equate to a formal accusation against any party, and it only becomes actionable once the panel reaches a decision.

The statement from Reliance further emphasises that the issues raised in this matter are currently sub judice, meaning they are still under judicial consideration, and that the company has always adhered to its contractual and legal obligations. Reliance expressed its disagreement with the mischaracterisation of facts in media reports.

The dispute originated from claims that Reliance did not comply with an approved investment plan, resulting in the underutilisation of capacity at the Dhirubhai-1 and Dhirubhai-3 fields, which are part of the KG-D6 block, the first and largest discoveries in the Krishna Godavari basin.

Natural gas production from the Dhirubhai-1 and Dhirubhai-3 fields began to lag behind company projections as early as 2011, just one year after production commenced. The fields ceased operations in February 2020, significantly ahead of their anticipated lifespan.

In its initial field development plan, Reliance had proposed an investment of $2.47 billion to achieve peak production of 40 million standard cubic metres per day of gas. However, this plan was revised in 2006 to an estimated $8.18 billion, with a goal of doubling output by drilling 31 wells by March 2011. Ultimately, only 22 wells were drilled, and of those, only 18 were brought into production. The company faced unexpected challenges such as sand and water ingress, which led to a downward revision of the estimated reserves from 10.03 trillion cubic feet to 3.10 trillion cubic feet.

The government attributed the underperformance to the company’s failure to adhere to the approved development plan and disallowed $3.02 billion of costs incurred by Reliance and its partners in the field’s development during the initial years.

Reliance has contested this disallowance, arguing that there is no provision in the KG-D6 contract permitting the government to reject cost recovery on these grounds. The company first served an arbitration notice in November 2011 to address the dispute, but proceedings were stalled due to the government's refusal to accept the appointed judges for the arbitration panel.

In 2014, Reliance nominated former UK judge Sir Bernard Rix as its arbitrator on the tribunal, replacing its initial choice, former Chief Justice of India S.P. Bharucha, who had recused himself. The government appointed former Chief Justice V.N. Khare, and later, the Supreme Court appointed Michael Kirby, a former judge of the Australian High Court, as the neutral arbitrator.

The government subsequently sought the removal of Rix and Kirby, alleging bias, but the Delhi High Court dismissed this request in December 2022 as not maintainable. The Supreme Court upheld this decision in January 2023, allowing the tribunal to proceed with its hearings.

In the arbitration, the government’s claims encompassed costs associated with unproduced gas, excess expenditure on installations, and additional marketing margins. The total of these claims was valued at over $30 billion.

Reliance and BP, who acquired a 30 per cent stake in KG-D6 and 21 other blocks for $7.2 billion in 2010, argue that the production sharing contracts under the New Exploration Licensing Policy permit operators to recover all development costs before sharing profits with the government. They contend that the challenges faced in gas production were due to geological surprises rather than negligence in operational management.

The company maintains that it has complied with all regulations and that all expenditures on the block received prior approval from the management committee, which includes representatives from the Directorate General of Hydrocarbons and the Oil Ministry. Sources indicate that Reliance and BP regard the government’s retroactive disallowance of certain costs as a violation of the signed contracts.

Gas output from the D1 and D3 fields was initially expected to reach 80 million standard cubic metres per day, but actual production figures were significantly lower, dropping to 35.33 million standard cubic metres per day in 2011-12, 20.88 million in 2012-13, and 9.77 million in 2013-14, ultimately leading to a complete halt in production by February 2020. The government had issued several notifications disallowing $3.02 billion in costs during the period when production targets were not met.

Reliance and BP assert that under the terms of the production sharing contract, contractors are entitled to recover all costs incurred, and there are no provisions allowing the government to disallow cost recovery. The contract stipulates that operators can deduct all capital and operational expenses from gas sales prior to profit-sharing with the government.

Reliance holds a 60 per cent interest in the KG-D6 block, with BP owning 30 per cent and Niko Resources holding the remaining 10 per cent. Niko exited the partnership due to financial difficulties, resulting in Reliance increasing its stake to 66.66 per cent, with BP holding the balance. The outcome of this arbitration may have significant implications for the future of energy production in India.

Silver Prices Plummet After Record High Amid Market Volatility

Dhurandhar Box Office Collection: 25 Days Update on Earnings

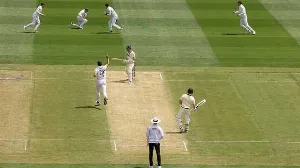

Melbourne Cricket Ground Pitch Rated Unsatisfactory for Ashes Test

Prime Minister Modi Reflects on India's 2025 Achievements