Carlyle to Acquire Majority Stake in Nido Home Finance

Carlyle Group, an American private equity firm, has announced its intention to acquire a majority stake in Nido Home Finance Limited (Nido), a wholly owned subsidiary of Edelweiss. The investment is valued at approximately ₹2,100 crore (around $230 million), which includes the purchase of a 45% stake from Edelweiss and a new equity infusion of ₹1,500 crore (approximately $165 million).

The deal is expected to enhance Nido’s capacity to serve the affordable housing market in India by bringing in additional capital and operational expertise. "This investment marks a key milestone, bringing in a high-quality, long-term partner to accelerate Nido’s growth," said Rashesh Shah, Chairman and Managing Director of Edelweiss.

Nido Home Finance, established in 2010, provides various home loan solutions focused on the affordable housing and mass-market segments. The firm operates across a wide geographic area, with a significant branch network servicing over 800 talukas, which are sub-districts throughout India. As of now, Nido manages assets worth approximately ₹4,804 crore (around $530 million).

According to company representatives, this partnership is expected to tap into the growing demand for housing finance in India, which has been bolstered by factors such as heightened affordability and improved access to formal credit.

For Carlyle, the investment underscores a commitment to the burgeoning housing finance sector in India, building on over two decades of experience in the country’s financial services market. The company has previously invested in other housing finance companies, reinforcing its strategy in this sector.

Aditya Puri, Senior Adviser to Carlyle in Asia and former CEO of HDFC Bank, is set to engage as an investor in this venture. Sunil Kaul, Partner at Carlyle and Asia Financial Services Sector Lead, expressed enthusiasm about the investment, stating, "We are excited to partner with Edelweiss to support the next phase of Nido’s growth journey. Housing remains a critical national priority for India, and we strongly believe in the growth potential of the housing finance industry."

The transaction is subject to regulatory review and approvals from several authorities, including the Reserve Bank of India, the National Housing Bank, and the Competition Commission of India.

Nido Home Finance reported a profit after tax of ₹19 crore on a total income of ₹200 crore in fiscal year 2025, maintaining consistent performance compared to the previous fiscal year. In the first quarter of fiscal year 2026, the company recorded a profit of ₹4 crore, a rise from ₹1 crore in the same period the previous year.

New Zealand Sets Record Partnership in T20 World Cup Victory

US Proposes June Deadline for Russia-Ukraine Peace Talks, Says Zelensky

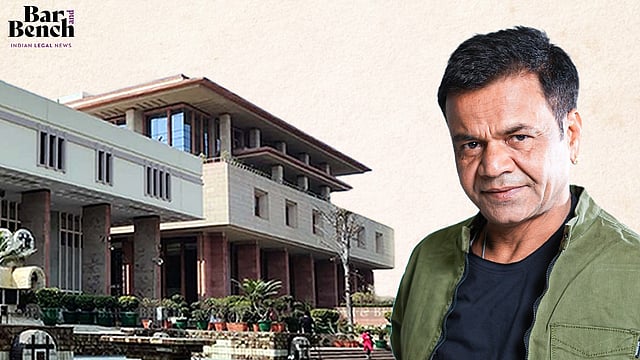

Delhi High Court Orders Actor Rajpal Yadav to Surrender Over Dues

Updated Fixtures Released Following Bangladesh's Exit from T20 World Cup