Yes Bank Reports 55% Increase in Q3FY26 Net Profit to ₹952 Crore

Yes Bank has announced a notable increase in its financial performance for the third quarter of the fiscal year 2026, reporting a net profit of ₹952 crore, a rise of 55% compared to the previous year. This improvement in profitability is largely attributed to the successful recovery of bad loans, which has positively impacted the bank's balance sheet.

The bank's net interest income also saw growth, rising by 11% year-on-year. This increase is a result of a wider net interest margin, which reflects the difference between the interest income generated by the bank and the interest paid out to its depositors.

Yes Bank has been working diligently to enhance its asset quality after facing significant challenges in the past. The bank has focused on strengthening its recovery mechanisms for non-performing assets (NPAs), which are loans that borrowers have failed to repay. This strategic shift appears to be paying off, as the latest results demonstrate a stronger financial position.

According to the bank's announcement, efforts to mitigate NPAs have resulted in improved investor confidence, and this is evident in the share price recovery observed over recent months. The dedication to prudent financial management has been crucial in restoring faith among stakeholders, including investors and clients.

In a statement, a spokesperson for Yes Bank remarked, "Our focus on strengthening asset quality and enhancing operational efficiencies continues to yield positive results. We remain committed to maintaining this momentum in the coming quarters."

In addition to the recovery efforts, Yes Bank has been working to diversify its loan portfolio and expand its customer base. The bank aims to attract a wider range of clients, including both retail and corporate customers, to ensure sustainable growth in a competitive banking landscape.

As the financial sector continues to navigate uncertainties arising from global economic factors, institutions like Yes Bank are under pressure to improve their operational frameworks and deliver results that align with investor expectations. The recent quarterly performance is a step towards achieving long-term stability and profitability.

Looking ahead, analysts predict that if Yes Bank continues its current trajectory of loan recovery and effective financial management, it could further strengthen its market position. Investors and stakeholders will be keenly observing the bank’s forthcoming reports, aiming to gauge the sustainability of its growth strategies.

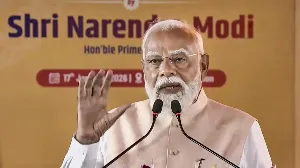

PM Modi Addresses Rally in Malda, Critiques West Bengal Government

Indian Prime Minister Launches First Sleeper Vande Bharat Train

Positive Developments in Iran Amid Protests and Tensions

HDFC Bank Reports 11.5% Increase in Q3FY26 Net Profit