RBL Bank Reports Net Profit Increase to ₹214 Crore in Q3 FY26

RBL Bank has announced a significant rise in its net profit for the third quarter of the financial year 2025-26, reaching ₹214 crore. This figure marks a considerable increase from the previous year, signalling recovery and growth within the institution. The bank’s loan portfolio has also surpassed the ₹1 lakh crore mark, reflecting a robust demand for loans and an expanding customer base.

The increase in net profit is attributed to several factors, including a decline in non-performing assets. The bank reported an improvement in its Gross Non-Performing Assets (GNPA) ratio, which now stands at 1.8%, down from higher levels in the past. Likewise, the Net Non-Performing Assets (NNPA) ratio has also improved, currently recorded at 0.5%.

Vishwavir Ahuja, Managing Director and Chief Executive Officer of RBL Bank, commented on the performance, noting that the results reflect the bank’s commitment to enhancing its asset quality while fostering growth. He stated, “Our focus remains on prudent risk management and maintaining the quality of our loan book.”

The overall growth in loans indicates renewed consumer confidence and reflects the effects of improving economic conditions within the country. RBL Bank has been strategically repositioning itself by diversifying its loan offerings and enhancing customer service to attract a wider demographic.

As per the bank’s reports, the retail banking business has shown especially strong performance, contributing significantly to the overall loan growth. The bank is also expected to continue expanding its digital banking services, which have gained traction amid evolving consumer preferences toward online banking solutions.

Looking ahead, RBL Bank aims to maintain this growth trajectory, with plans to continue investing in technology and infrastructure to streamline operations and enhance customer experience. Analysts remain optimistic about the bank's prospects, given the positive developments in both asset quality and profitability.

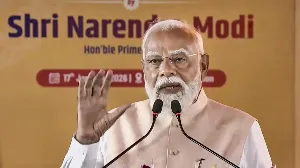

PM Modi Addresses Rally in Malda, Critiques West Bengal Government

Indian Prime Minister Launches First Sleeper Vande Bharat Train

Positive Developments in Iran Amid Protests and Tensions

HDFC Bank Reports 11.5% Increase in Q3FY26 Net Profit