E-commerce Delivery Costs Set to Rise After 18% GST Implementation

E-commerce Delivery Costs Set to Rise After 18% GST Implementation

E-commerce platforms in India, including Zomato and Swiggy, will charge 18% Goods and Services Tax on delivery fees starting September 22, 2025.

E-commerce delivery services in India, such as those provided by Zomato, Swiggy, and Blinkit, are poised for an increase in costs due to a new 18% Goods and Services Tax (GST) on delivery charges. This change will take effect on 22 September 2025, following a decision by the Goods and Services Tax Council during its recent meeting.

Changes in Taxation

The new taxation rule was established during the GST Council’s 56th meeting, held on 3 September 2025. Previously, delivery charges from e-commerce platforms were exempt from GST, allowing customers to benefit from lower prices. However, under the revised framework, operators in this sector must now absorb or pass on this additional financial burden to consumers.

As a result, customers using these services may find themselves paying more, particularly if companies opt to increase delivery fees or other associated service charges. Industry experts suggest that the implementation of this tax will significantly impact the pricing structure of goods delivered through these platforms.

Potential Hike in Costs

Multiple reports indicate that e-commerce firms are assessing the potential financial repercussions of this new GST rate. According to sources, there is a strong likelihood that these companies will transfer the increased costs to customers to mitigate losses. A senior executive from a leading food delivery service stated, "We would have no other option but to pass on that hit to customers, so you can expect delivery fees going up, or even delivery partner earnings taking a hit. The cost of food could also go up.”

Effect on Consumers

When the new GST rate is applied, the financial implications for consumers could be tangible. For instance, an average order costing around ₹500 may already include various taxes, such as approximately ₹88 in restaurant GST and nearly ₹15 for the delivery platform fee. If the new 18% GST on delivery services is passed on to customers, it could significantly increase the total cost of their orders.

Industry analysts are currently reviewing the implications of these changes, noting that while basic delivery services will see a marked increase in fees, customers who currently pay for premium delivery services may not experience the same level of impact. Nevertheless, the overall sentiment indicates a concerning shift that could dampen demand for these delivery services.

Legal Context

The introduction of the new GST on delivery services aims to clarify the legal uncertainties that have surrounded the taxation of such offerings. By categorising local delivery services under the Goods and Services Tax framework, it is anticipated that there will be reductions in related legal disputes and improved compliance in the long term.

Industry Responses

As the implementation date nears, companies like Zomato, Swiggy, and Blinkit are expected to formulate strategies in response to this taxation change. The outlook for the e-commerce and quick delivery market is thus becoming more complex as companies weigh their options concerning pricing policies and customer retention strategies.

In conclusion, the imposition of 18% GST on delivery services in India signifies a critical shift in the regulatory landscape affecting e-commerce operators. As the date of enforcement approaches, consumers and companies alike will need to navigate the implications of these changes on pricing and service availability.

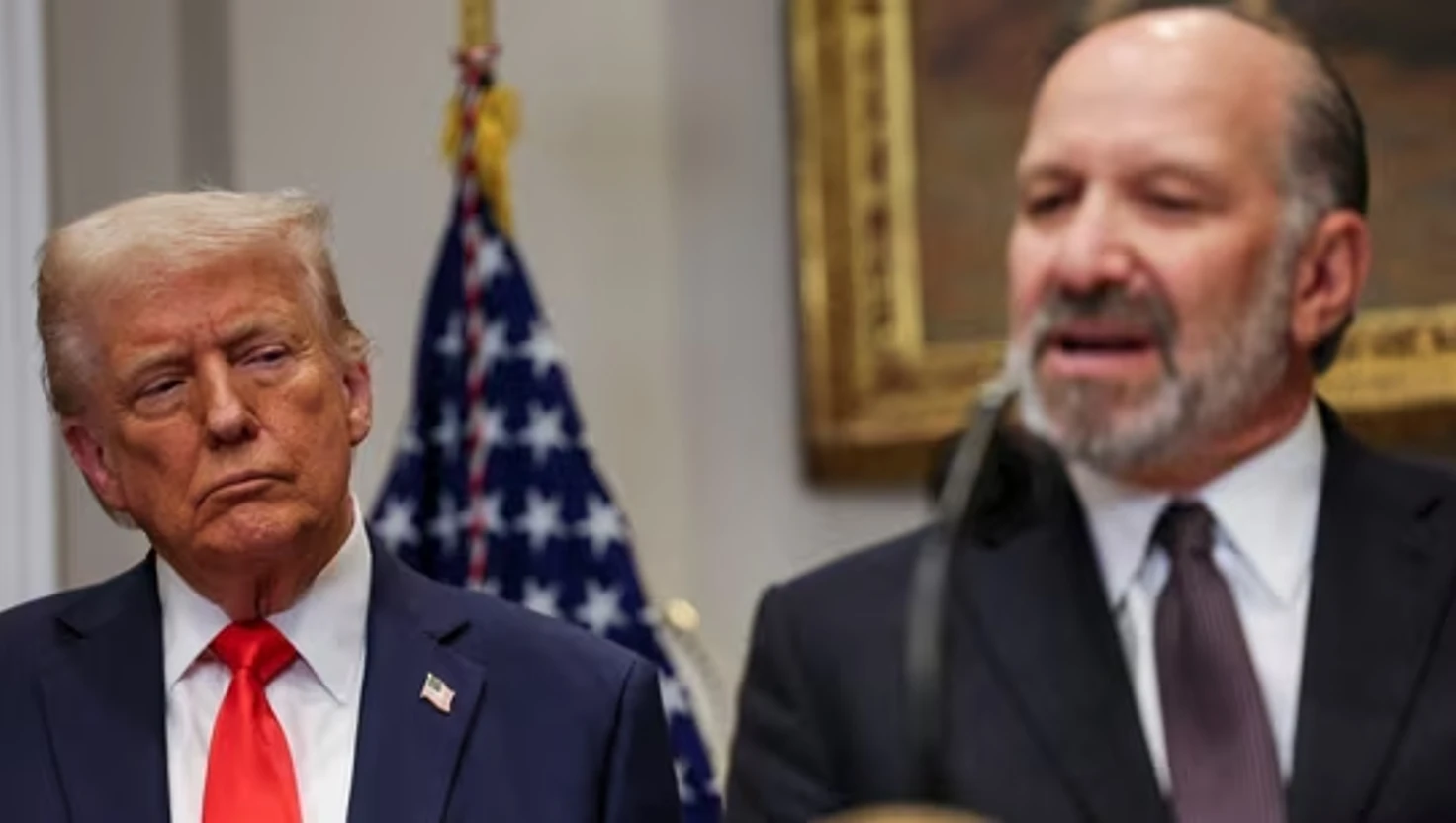

"We've Lost India, Russia To Deepest, Darkest China", says Donald Trump

Donald Trump asserts the US has lost ties with India and Russia to China, criticising New Delhi's energy trade and market openness.

| 2025-09-06

India Implements New GST Rates on Car Purchases

The Indian government has revised GST rates for cars, aiming to boost affordability and enhance personal mobility.

| 2025-09-05

Apple's Siri Upgrade Could Use Google Gemini AI by 2026

Apple plans to enhance Siri with Google's Gemini AI, a move aimed at improving voice assistant capabilities by 2026, amid rising competition.

| 2025-09-05

Kalyani Priyadarshan Shines as First Female Superhero in Lokah

Kalyani Priyadarshan's remarkable debut in Lokah Chapter 1: Chandra highlights her family's cinematic legacy and reshapes Malayalam cinema.

| 2025-09-05

Asia Cup 2025: India Secures Dominant Victory Over Malaysia

India triumphed over Malaysia 4-1 in the Asia Cup Super 4s, boosting their chances for the final. The team displayed resilience despite an early setback.

| 2025-09-05