UPL Limited Reports Profit Growth Driven by Strong Demand in Americas

UPL Limited, an Indian agrochemical manufacturer, has reported a significant financial turnaround, returning to profitability in the second quarter of the fiscal year. The company attributed this positive performance largely to increased demand for its products in the Americas, particularly in Brazil and Argentina, which played a crucial role in boosting sales.

For the quarter ending in September, UPL Limited recorded a consolidated net profit of ₹5.53 billion (approximately $62.9 million). This marks a remarkable recovery from the net loss of ₹585 crore reported during the same period last year. The surge in profits was driven by a 63% increase in revenue from North America, primarily due to strong sales of herbicides. Additionally, Latin America saw a 13% rise in revenue, propelled by heightened demand for fungicides in Brazil and a rebound in sales from Argentina.

Despite facing challenges in India due to adverse weather conditions affecting domestic sales, UPL’s total revenue rose by 8.4% year-on-year, reaching ₹120.19 billion. The company’s performance has led to an optimistic revision of its earnings before interest, taxes, depreciation, and amortisation (EBITDA) margin forecast, now estimated to be between 12% and 16% for the full year.

The surge in agrochemical sales signals a broader trend within the agricultural sector, highlighting the increasing global demand for crop protection products. Analysts suggest that this demand provides a lifeline for agrochemical companies, with UPL Limited’s results reflecting a growing resilience in the industry. In particular, the strong performance in the Americas has fuelled optimism around the ongoing growth potential of the sector, even as unpredictable weather patterns pose challenges in various regions.

As climate change continues to alter agricultural practices and consumption patterns, companies like UPL Limited are adapting by focusing on international markets. The improved margin outlook indicates a strategic shift towards enhancing operational efficiency and diversifying product offerings globally. With food demand on the rise and weather-related volatility increasing, industry experts believe there are significant long-term opportunities for firms that can innovate and respond effectively to these challenges.

In response to this positive financial news, UPL Limited’s shares saw a modest increase, reflecting investor confidence in the company’s strategy and performance. The agrochemical sector is expected to remain a vital component of the global agricultural landscape, with companies actively seeking to leverage growth opportunities in emerging markets and adapt to changing environmental conditions.

Brazilian Model Reacts to Photo Used in Indian Political Controversy

India's Finance Minister Announces Next Phase of Bank Consolidation

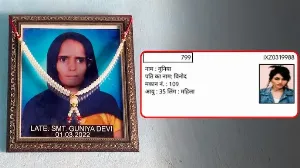

Deceased Woman's Name Appears on Voter List in Haryana

Singtel Plans to Sell Stake in Bharti Airtel Worth Rs 10,300 Crore