Tata Motors Passenger Vehicles to Announce First Quarterly Results

Tata Motors Passenger Vehicles Limited (TMPV), previously part of Tata Motors Limited, will disclose its inaugural financial results as an independent passenger vehicle company on Friday, 14 November 2025. This announcement was made through a regulatory filing with the stock exchanges.

The board of directors of TMPV will convene to approve both the audited standalone results and the unaudited consolidated results for the quarter and half-year ending 30 September 2025. This marks TMPV's first earnings report since the demerger, which separated its commercial vehicle and electric mobility divisions into distinct entities.

In its filing, the company stated, "A meeting of the Board of Directors of Tata Motors Passenger Vehicles Limited is scheduled on 14 November 2025, to consider and approve the audited standalone and unaudited consolidated financial results for the quarter and half-year ended 30 September 2025."

The company also noted that the trading window has been closed since 24 September, adhering to insider trading regulations, and it will reopen 48 hours following the announcement of the financial results. An investor and analyst call is planned for the same day, with further details to be made available on the company’s official website.

The demerger is aimed at enhancing shareholder value and improving business focus, which is anticipated to have a significant impact on the company's financial performance. Investors are likely to monitor the upcoming results closely for early signs of profitability and operational independence in the new organisational structure.

In another related development, the name of the demerged commercial vehicle arm has changed from TML Commercial Vehicles Limited to Tata Motors Limited. This newly renamed entity has already submitted applications for the listing of its shares on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

According to company communications, the listing process typically requires 45 to 60 days, after which the stock exchanges will announce the trading date. The company informed its shareholders via email that, "The equity shares allotted to you and credited to your demat account will remain frozen in the depository system until the Stock Exchanges grant listing and trading permissions."

Brazilian Model Reacts to Photo Used in Indian Political Controversy

India's Finance Minister Announces Next Phase of Bank Consolidation

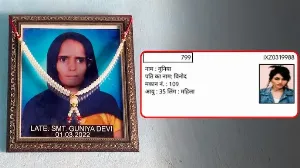

Deceased Woman's Name Appears on Voter List in Haryana

Singtel Plans to Sell Stake in Bharti Airtel Worth Rs 10,300 Crore