IT Shares Decline as Indian Markets React to Anthropic AI Launch

On February 4, 2026, Indian equity indices demonstrated muted trading activity as significant losses within the information technology sector heavily influenced overall market dynamics. The SENSEX fluctuated within a range of 656 points during the day, indicating a volatile session. By approximately 9:27 am IST, the SENSEX was up by 81 points at 83,823, while the NIFTY50 index had decreased by 57 points to 25,785.

The decline in IT shares was notable, attributed to investor reactions to Anthropic's recent launch of new artificial intelligence products. Reports circulated suggesting that these AI tools could disrupt established business models across various sectors, including software, legal, and data services. As a result, the NIFTY IT index on the National Stock Exchange fell more than 5%, with all ten companies within the index experiencing losses. Persistent Systems faced the largest drop, with a decrease of over 6.5%.

Major IT firms such as Infosys, Tata Consultancy Services, HCL Technologies, and Tech Mahindra also reported declines between 5% and 6.4%. Anthropic's new tools, which can conduct tasks traditionally managed by costly software, have raised concerns that they might threaten the high-margin subscription revenues dependent on longstanding client relationships within these markets.

The mixed performance of the broader market was evident as other sectors countered some of the losses in IT shares. Gains were primarily noted in the NIFTY Oil & Gas index, which rose by over 1.5% thanks to strong performances from Reliance Industries and other energy companies. Additionally, sectors such as Auto, Consumer Durables, Metal, and Fast-Moving Consumer Goods (FMCG) recorded increases ranging from 0.55% to 1.25%.

In contrast, ONGC emerged as the top gainer in the NIFTY50 index with a rise of 3.56%, reaching ₹266. Coal India, NTPC, Mahindra & Mahindra, Power Grid, ICICI Bank, and Reliance Industries all experienced gains of between 1.5% and 2.25%. The overall market breadth leaned positive, with 1,863 stocks advancing against 860 declining on the National Stock Exchange.

Asian markets were also feeling the impact of technology stock sell-offs, with Japan’s Nikkei falling by 0.67%. Meanwhile, China’s Shanghai Composite rose by 0.25%, and South Korea’s KOSPI experienced a slight increase of 0.74%. The fluctuations in these indices reflect the ongoing challenges faced by tech sectors due to heightened apprehensions surrounding recent advancements in artificial intelligence and its potential to disrupt traditional business practices.

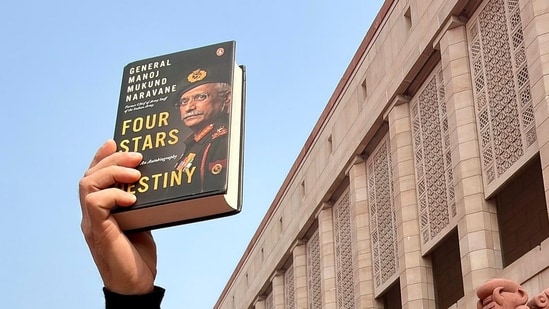

General Naravane's Memoir Ignites Political Debate in India

Xi Jinping and Donald Trump Discuss Relations After Meeting Putin

Mukesh Ambani Predicts 8-10% Growth for India's Economy

Investigation Launched into Death of Seif al-Islam Gaddafi in Libya