Securities Regulator Proposes Reforms for Market Professionals in India

The Securities and Exchange Board of India (Sebi) has unveiled significant proposals aimed at reforming the certification process for professionals within the securities market. This initiative seeks to broaden participation and elevate skill standards to meet the changing demands of the market. In a consultation paper published on Thursday, Sebi recommended an expansion of the definition of "Associated Persons". This revision would not only encompass those currently employed by intermediaries and regulated entities but also individuals aspiring to engage within the securities market, as reported by Press Trust of India (PTI).

According to Sebi, this adjustment is expected to attract younger individuals and improve employability opportunities for students and prospective professionals. The regulator elaborated that the proposed definition would be more inclusive, integrating terms such as "a regulated entity", "intending to be engaged", and "directly and indirectly".

To bolster skills development further, Sebi has suggested that the National Institute of Securities Markets (NISM) implement long-term certification courses lasting three months or more. These courses can be delivered in various formats, including physical, online, or hybrid methods. This initiative aims to complement the existing examination-based certification framework and provide an alternative pathway for obtaining NISM and Continuing Professional Education (CPE) credits.

In addition, Sebi proposed the elimination of certain exemption categories, including those for "principals", individuals aged over 50, and those with more than a decade of experience. A new exemption category would be introduced for individuals aged 50 or older with a minimum of ten years of relevant experience, allowing them to qualify through classroom credits or approved long-term courses, rather than traditional examinations.

Another significant proposal includes the allowance for CPE programmes to be conducted electronically or in hybrid formats, moving away from the current requirement for in-person attendance. This change is anticipated to enhance accessibility for professionals across India, particularly for those residing outside major financial hubs.

The consultation paper noted that the emergence of new products and services has resulted in a rise in the number of regulated entities and professionals operating within the securities market. Consequently, there is a pressing need to update the certification requirements accordingly.

Sebi has invited public feedback on these proposals until 27 November, signalling its intent to incorporate stakeholder insights into the final reforms.

Brazilian Model Reacts to Photo Used in Indian Political Controversy

India's Finance Minister Announces Next Phase of Bank Consolidation

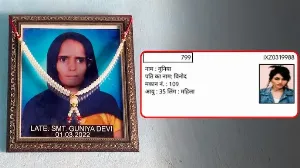

Deceased Woman's Name Appears on Voter List in Haryana

Singtel Plans to Sell Stake in Bharti Airtel Worth Rs 10,300 Crore