Ola Electric Reports Q2 Losses Amid Revenue Decline and Outlook Adjustments

Ola Electric Mobility Limited has locked its shares in a 5% lower circuit on 6 November following the announcement of its quarterly financial results for the period ending September 30. The company has also revised its revenue and margin forecasts for the current financial year.

For the second quarter, Ola Electric reported a net loss of ₹418 crore, a reduction from last year's loss of ₹495 crore. This result was below the expectations of Kotak Institutional Equities, which had anticipated a narrower loss of ₹346 crore, driven by cost control strategies and a shift towards its Gen-3 electric vehicle platform.

The company’s revenue for the quarter plummeted by 43.2%, amounting to ₹690 crore, down from ₹1,214 crore in the same period last year. This figure aligns closely with Kotak's projection of ₹685 crore, reflecting a significant drop in sales volumes.

Ola Electric has adjusted its revenue forecast for the full year, now estimating between ₹3,000 crore and ₹3,200 crore, a sharp decline from its previous guidance of ₹4,200 crore to ₹4,700 crore. The company also reduced its margin expectations for its automotive division to approximately 5%, down from earlier targets.

The number of electric scooters sold by Ola Electric fell by 44% compared to the previous year, with 55,000 units sold, marking a 19% decrease sequentially. Despite this, the company reported that earnings before interest, tax, depreciation, and amortisation (EBITDA) losses narrowed to ₹203 crore from ₹379 crore during the same quarter last year, although still higher than the anticipated loss of ₹161 crore.

Ola Electric's automotive segment achieved a major milestone by turning EBITDA positive for the first time, supported by a gross margin of 30.7% and a nearly 52% reduction in operating costs, according to the company’s letter to shareholders. The company also generated positive cash flow from operations amounting to ₹15 crore.

In a statement, the company mentioned, "In the recently concluded festive season, sales were flat year on year. We see this as a healthy transition phase before the next wave of mainstream adoption, driven by value-conscious consumers recognising the superior performance and lower cost of electric vehicle ownership."

The letter further elaborated on the competitive landscape, noting that many original equipment manufacturers (OEMs) are engaging in aggressive discounting and high channel incentives to capture market share. Ola Electric has chosen a different path, concentrating on enhancing its cost structure, product quality, and reliability, while aiming to improve margins.

As of Thursday, shares of Ola Electric Mobility were trading at ₹47.55, reflecting a 5% decline following the earnings announcement. The stock price remains below its initial public offering price of ₹76 and is currently 69% lower than its peak of ₹157 post-listing.

The challenges faced by the company come amid increasing scrutiny regarding sales data discrepancies, quality concerns, and missing trade certificates at retail outlets. CEO Bhavish Aggarwal indicated that Ola Electric has lost some market share but is prioritising consolidation over aggressive marketing strategies. He stated, "One and a half years ago, there were two competitors in the market, us and TVS. Now, there are six… and the market has not grown... In my view, the right strategy is not to buy market share at this point."

Looking ahead, the company aims to optimise operational costs further over the next two quarters, with a target to reclaim market share in the electric two-wheeler segment and to become a leading player by fiscal year 2027. Aggarwal expressed ambitions for Ola Electric to secure a market share of approximately 25%.

In addition to its automotive business, Ola Electric is venturing into the battery energy storage system (BESS) market with a new product named Shakti, intended to leverage the 4680 Bharat cells launched earlier this year. The company projects that Shakti could generate at least ₹1,000 crore in revenue next year.

Brazilian Model Reacts to Photo Used in Indian Political Controversy

India's Finance Minister Announces Next Phase of Bank Consolidation

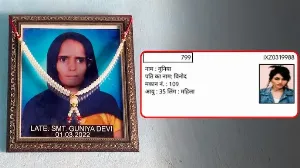

Deceased Woman's Name Appears on Voter List in Haryana

Singtel Plans to Sell Stake in Bharti Airtel Worth Rs 10,300 Crore