Indian Stock Market Declines Amid Volatility and Foreign Exits

On Thursday, Indian equity benchmarks, the Nifty50 and BSE Sensex, closed in negative territory following a day characterised by significant volatility. The Nifty50 index fell by 87.95 points, equivalent to a decrease of 0.34 per cent, ending the session at 25,509.70. The BSE Sensex experienced a decline of 148.14 points, or 0.18 per cent, concluding at 83,311.01 after oscillating between a high of 83,846.35 and a low of 83,237.65.

The downturn was largely driven by foreign institutional investors (FIIs) withdrawing funds and notable selling pressure on shares of ICICI Bank. Among the constituents of the Sensex, Power Grid, Eternal, Bharat Electronics, Bajaj Finance, ICICI Bank, and NTPC were identified as the primary losers. Conversely, Asian Paints, Reliance Industries, Mahindra & Mahindra, and UltraTech Cement emerged as the top gainers during the trading session.

The Indian markets were closed on Wednesday in observance of Guru Nanak Jayanti. On Tuesday, FIIs sold equities amounting to ₹1,067.01 crore, while domestic institutional investors (DIIs) acquired stocks valued at ₹1,202.90 crore, according to data from the exchanges.

In contrast, Asian markets displayed a positive trend, with gains noted in South Korea's Kospi, Japan's Nikkei 225, Shanghai's SSE Composite, and Hong Kong's Hang Seng. European markets, however, traded lower, and US markets finished higher on Wednesday.

Vinod Nair, Head of Research at Geojit Investments Limited, commented on the situation, stating, "Volatility dominated the domestic market, with broad-based profit-booking seen amid continued FII outflows, despite supportive Asian markets. Early optimism from the inclusion of four Indian companies in the MSCI Global Standard Index and strong US macro data was offset by weak domestic PMI readings, indicating softening sentiment."

The Purchasing Managers' Index (PMI) for India's services sector revealed a slowdown, reaching a five-month low in October. This decline was attributed to heightened competitive pressures and heavy rainfall affecting certain areas. The HSBC India Services PMI Business Activity Index dropped from 60.9 in September to 58.9 in October, marking the slowest growth pace since May. In PMI terminology, a figure above 50 indicates expansion, while a reading below 50 signifies contraction.

Earlier on Tuesday, the BSE Sensex recorded a decrease of 519.34 points, or 0.62 per cent, closing at 83,459.15, while the Nifty50 index dropped by 165.70 points, or 0.64 per cent, to finish at 25,597.65.

(Disclaimer: Recommendations and views on the stock market, along with advice on other asset classes or personal finance management, are those of the respective experts and do not reflect the views of The Times of India.)

Brazilian Model Reacts to Photo Used in Indian Political Controversy

India's Finance Minister Announces Next Phase of Bank Consolidation

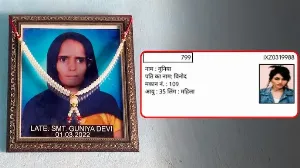

Deceased Woman's Name Appears on Voter List in Haryana

Singtel Plans to Sell Stake in Bharti Airtel Worth Rs 10,300 Crore