Indian Rupee Hits Record Low of 91.58 Against US Dollar

The Indian rupee has fallen to a historic low of 91.58 against the United States dollar, raising concerns among investors and economists regarding the currency's trajectory. This decline is linked to various factors, including rising inflation, geopolitical tensions, and fluctuations in global oil prices.

The currency experienced sharp depreciation, reflecting the ongoing pressures in the Indian economy. As a significant developing market, India is closely monitored for these shifts, given its substantial import reliance, especially on oil, which has been further exacerbated by recent spikes in crude prices.

Experts suggest that the weakening of the rupee could have widespread implications, impacting inflation rates and import costs. According to financial analysts, a depreciating currency can lead to increased prices for everyday goods, further straining household budgets.

Dr. Raghuram Rajan, former Governor of the Reserve Bank of India, commented, "The fall of the rupee against the dollar is concerning, as it could dampen consumer confidence and slow down economic growth."

The Reserve Bank of India (RBI) is expected to intervene in the foreign exchange market to stabilise the situation. Market strategists anticipate that the central bank may take measures to bolster the currency as the government assesses the impact of this depreciation on economic stability.

This scenario underscores the complex interplay between global markets and local economies. Analysts are keenly watching how domestic policies will adapt to counteract the repercussions of the falling rupee and support the nation's financial health in the wake of increasing uncertainties.

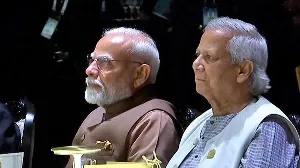

India Recommends Withdrawal of Families of Officials in Bangladesh

EU and India Approach Historic Free Trade Agreement

Historic Moment: Simran Bala to Lead All-Male CRPF Unit

Pakistan Defence Minister Opens Counterfeit Pizza Hut Outlet