Indian Rupee Declines Against US Dollar Following Trade Deal

On February 4, 2026, the Indian rupee fell by 11 paise, settling at 90.43 against the United States dollar. This depreciation follows a significant rally in the previous trading session, which was spurred by the recent announcement of a trade deal between India and the U.S. Forex traders indicated that the decline was influenced by suspected dollar buying activities carried out by corporations and importers.

Despite the initial positive sentiment associated with the India-U.S. trade deal, market participants remain cautious due to the absence of a final and officially released agreement, which has left many uncertain about its terms. On this day, the rupee opened at 90.35, reached a high of 90.26, and dipped to a low of 90.54 during trading.

Notably, on the preceding day, February 3, the Indian rupee had recorded its largest gain in a seven-year period, appreciating by 117 paise or 1.28%, and closing at 90.32 against the dollar. This surge was attributed to the optimism surrounding the trade agreement.

Analysts have pointed out that the rupee's slight dip can be linked to the search for greater clarity regarding the specifics of the agreement. Additionally, a weaker-than-expected Purchasing Managers' Index (PMI) for services has contributed to the currency's downward pressure. Anuj Choudhary, a research analyst at Mirae Asset ShareKhan, noted, “We expect the rupee to trade with a positive bias as the India-U.S. trade deal may boost domestic market sentiments.”

Choudhary also highlighted that further gains could be limited by high crude oil prices and tensions between the U.S. and Iran. Brent crude oil prices were trading at $67.26 per barrel, reflecting volatility in commodity markets influenced by geopolitical concerns.

Amid these fluctuations, India's domestic equity markets showed resilience, with the Sensex rising by 78.56 points, reaching 83,817.69, while the Nifty index also increased by 48.45 points to settle at 25,776.

On the foreign institutional investment front, investors purchased equities worth ₹5,236.28 crore on February 3, signalling strong market interest despite the currency's recent fluctuations. Furthermore, the services sector in India showed signs of improvement, as the HSBC India Services PMI Business Activity Index increased to 58.5 in January, driven by an uptick in new business and tech investment.

The Indian rupee's trajectory remains closely monitored by traders, as they anticipate potential intervention by the Reserve Bank of India, particularly in light of the currency's recent recovery following the trade agreement announcement. Analysts are suggesting that the rupee may trade within a range of 90 to 90.60 in the short term while the market absorbs further developments regarding the trade deal and its implications for the Indian economy.

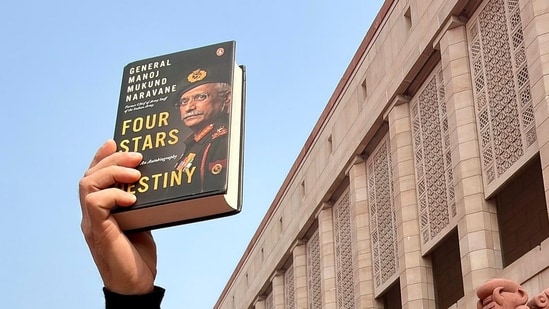

General Naravane's Memoir Ignites Political Debate in India

Xi Jinping and Donald Trump Discuss Relations After Meeting Putin

Mukesh Ambani Predicts 8-10% Growth for India's Economy

Investigation Launched into Death of Seif al-Islam Gaddafi in Libya