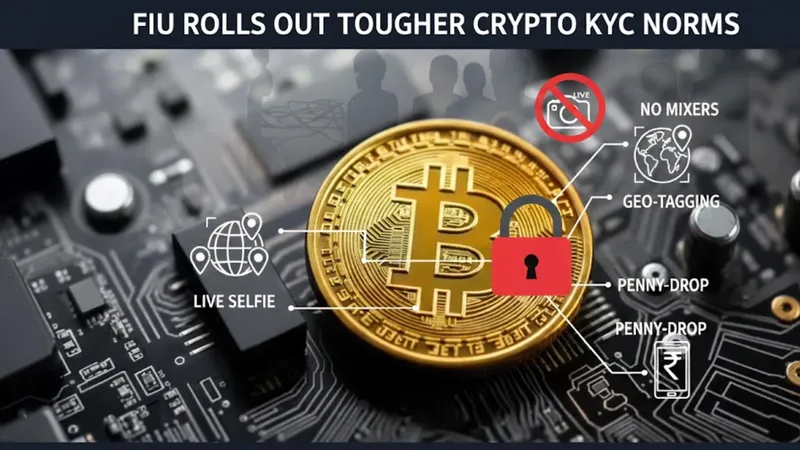

India Implements Stricter KYC Rules for Cryptocurrency Users

India's Financial Intelligence Unit (FIU) has introduced tougher Know Your Customer (KYC) regulations for cryptocurrency users, which will require individuals to submit live selfies and geo-tagging information as part of the verification process. This move aims to enhance transparency and combat potential money laundering associated with digital currencies.

The crypto market in India has seen significant growth, prompting regulators to take action to ensure safety and security for users. The updated KYC guidelines were announced amid growing concerns regarding the proliferation of scams and illicit activities linked to cryptocurrencies.

According to the FIU, the new rules will necessitate that individuals verify their identities through live selfies taken during the KYC process. Additionally, users will be required to provide location data to confirm that they are operating within Indian jurisdiction. This step marks a shift towards more stringent oversight of the cryptocurrency market, which has often been perceived as a regulatory grey area.

The introduction of such measures is receiving mixed reactions from crypto enthusiasts and industry experts. Some local analysts support the initiative, arguing that it creates a safer environment for investors and promotes legitimacy in the cryptocurrency sector. Others, however, raise concerns that these requirements may deter new users from entering the market or infringe on personal privacy.

“While protecting users is essential, the approach should not be so restrictive that it limits innovation within the crypto space,” remarked an industry expert during a recent conference.

As India's government continues to explore the possibility of regulating cryptocurrencies further, stakeholders are keenly observing how these regulations will evolve. The FIU has stated that more comprehensive rules for digital assets will be forthcoming as the agency assesses the effectiveness of these initial measures. This regulatory shift is significant, given that it represents one of the government's most proactive stances towards regulating the cryptocurrency landscape in recent years.

The global crypto market is also adapting to increased regulatory scrutiny as various countries grapple with similar concerns regarding financial crime and market integrity. With India now implementing these measures, it may encourage other nations to consider their own regulatory frameworks in light of evolving technologies and financial practices.

As the world adjusts to the rapid development of digital currencies, maintaining a balance between innovation and regulation remains a crucial challenge. India's latest KYC requirements are a clear indication of the country's intent to create a safer and more regulated environment for cryptocurrency transactions, setting a precedent that may influence other jurisdictions contemplating similar actions.

Iran Threatens Retaliation Amid Ongoing Anti-Government Protests

Donald Trump Urges Cuban Government to Negotiate Urgently

Indian Space Research Organisation to Launch New Satellite

BJP Raises Concerns Over Attack on Opposition Leader's Convoy in Bengal