Groww IPO Subscription Status: Day 2 Insights

The initial public offering (IPO) of Groww, a prominent digital investment platform in India, has entered its second day of subscription on 6 November 2025. As of the close of the first day, the IPO had achieved an overall subscription rate of 0.57 times. Notably, the segment allocated for retail investors was fully subscribed, registering a demand of 1.91 times.

Details of the Groww IPO The Groww IPO is a book-building offering worth ₹6,632.3 crore, which includes a fresh issue valued at ₹1,060 crore and an offer for sale amounting to ₹5,572.30 crore. The share price is set within a band of ₹95 to ₹100.

The allotment results are expected to be announced by 10 November 2025, with the tentative listing on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) scheduled for 12 November 2025.

The IPO is being managed by several key financial institutions, including Kotak Mahindra Capital Company Limited, J.P. Morgan India Private Limited, Citigroup Global Markets India Private Limited, Axis Capital Limited, and Motilal Oswal Investment Advisors Limited. The registrar for the offering is MUFG Intime India Private Limited.

Subscription Status on Day 2 As of the morning of 6 November 2025, the subscription figures are as follows:

- Qualified Institutional Buyers (QIBs): 0.10 times

- Non-Institutional Investors: 1.00 times

- Retail Individual Investors (RIIs): 2.86 times

- Total Subscription: 0.85 times

This indicates a significant interest from retail investors, while institutional participation remains subdued compared to expectations.

Day 1 Subscription Overview On the first day of subscription, the figures were as follows:

- Qualified Institutional Buyers (QIBs): 0.10 times

- Non-Institutional Investors: 0.59 times

- Retail Individual Investors (RIIs): 1.91 times

- Total Subscription: 0.57 times

Utilisation of Proceeds It is important to note that Groww will not benefit from the proceeds of the offer for sale (OFS) portion, as these funds will be distributed directly to the selling shareholders. The company plans to allocate the net proceeds from the fresh issue primarily towards:

- Performance marketing initiatives

- Investment in cloud infrastructure and potential acquisitions

- Brand enhancement efforts

- Augmentation of capital in its subsidiaries, Groww Creditserv Technology Private Limited and Groww Invest Tech Private Limited, to support the margin trading facility (MTF) business

- General corporate needs

Overview of Groww Founded in 2016, Groww has rapidly established itself as a leading direct-to-consumer (D2C) digital investment platform. Initially launched as a mutual fund distribution service, it has since expanded its offerings to include equities, IPOs, exchange-traded funds (ETFs), and derivatives, such as futures and options. As of June 30, 2025, Groww is recognised as India's largest investment platform by active users on the NSE.

In a statement regarding the IPO, a representative from Groww commented, "We are committed to providing our users with the best investment opportunities and are excited about this next phase of growth for our company."

This IPO marks a significant milestone for Groww as it aims to enhance its market presence and service offerings in the evolving financial landscape of India.

Brazilian Model Reacts to Photo Used in Indian Political Controversy

India's Finance Minister Announces Next Phase of Bank Consolidation

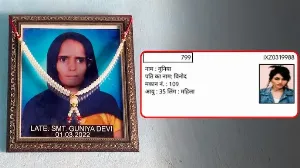

Deceased Woman's Name Appears on Voter List in Haryana

Singtel Plans to Sell Stake in Bharti Airtel Worth Rs 10,300 Crore