Gold and Silver Prices Surge Amid US Dollar Decline

Gold prices experienced a notable increase on Thursday, November 6, 2025, recovering from previous declines to reach Rs 1,24,700 per 10 grams in Delhi. This rebound was attributed to renewed buying interest from traders and supportive global market conditions. The price of gold with 99.5% purity also climbed, closing at Rs 1,24,100 per 10 grams, up from Rs 1,23,500 earlier in the week, according to the All India Sarafa Association.

Similarly, silver prices surged by Rs 1,800 to Rs 1,53,300 per kilogram, up from Rs 1,51,500 on Tuesday. The increase in prices followed a closure of bullion markets on Wednesday in observance of the Prakash Gurpurb Sri Guru Nanak Dev holiday, which also saw stock markets and banks in various states shutting down.

In the international markets, spot gold rose by $28.96, or 0.73%, reaching $4,008.19 per ounce. Spot silver was also up, trading 1.22% higher at $48.60 an ounce. Analysts believe that the rise in gold prices was driven by a combination of factors, including a downturn in the US dollar, which fell by 0.29% to 99.97 on the dollar index after reaching a multi-month peak the previous day.

The ongoing US government shutdown, now the longest in history, has added to market uncertainties, leading to increased demand for gold as a safe-haven asset. In times of economic instability, investors tend to flock to gold, which is perceived as a stable store of value.

In futures trading on the Multi Commodity Exchange, both gold and silver contracts saw gains on Thursday, influenced by global trends. Gold futures for December delivery peaked at Rs 1,21,550 per 10 grams, while silver futures reached Rs1,49,040 per kilogram.

Market participants are advised to remain cautious as they await insights from several Federal Reserve officials, including John Williams and Michael S. Barr. Their forthcoming speeches are anticipated to shed light on the central bank's monetary policy trajectory, which could impact bullion prices in the near term.

A commodities market expert noted, "The commentary will provide more impetus on the central bank's monetary policy path and could influence the near-term trajectory for bullion prices."

Despite the recent uptick in prices, analysts are divided on the short-term outlook for gold and silver. According to Abhilash Koikkara, Head of Forex and Commodities at Nuvama Professional Clients Group, gold is facing potential corrective movements following its recent rally. He suggests that prices may test the lower range of Rs 117,000 to Rs115,000 before establishing a firmer support base for future gains.

For silver, the outlook appears more bearish as it struggles to maintain upward momentum. Analysts indicate that unless silver prices surpass a key resistance level of Rs 148,700 decisively, they may remain vulnerable to further declines.

In conclusion, while the recent bounce in gold and silver prices offers some optimism, the market remains sensitive to broader economic signals and developments in US monetary policy. Investors are encouraged to monitor these dynamics closely as they navigate the current trading landscape.

Brazilian Model Reacts to Photo Used in Indian Political Controversy

India's Finance Minister Announces Next Phase of Bank Consolidation

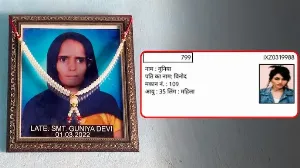

Deceased Woman's Name Appears on Voter List in Haryana

Singtel Plans to Sell Stake in Bharti Airtel Worth Rs 10,300 Crore